Introduction to Thruster Finance Credits

In the ever-evolving world of finance, finding ways to optimize your rewards can feel like a daunting task. Whether you’re an experienced investor or just starting out, understanding how to maximize your benefits is key. Enter Thruster Finance Credits—an innovative tool designed to elevate your financial strategy and help you earn more from every transaction. With these credits at your disposal, you’ll be navigating the financial landscape with newfound confidence and efficiency. Curious about how they work? Let’s dive into the specifics of Thruster Finance Credits and discover how they can transform your approach to earning rewards in this dynamic market.

ALSO READ: Planning Excellence Outcome: Optimizing Business Decisions

How do Thruster Finance Credits Work?

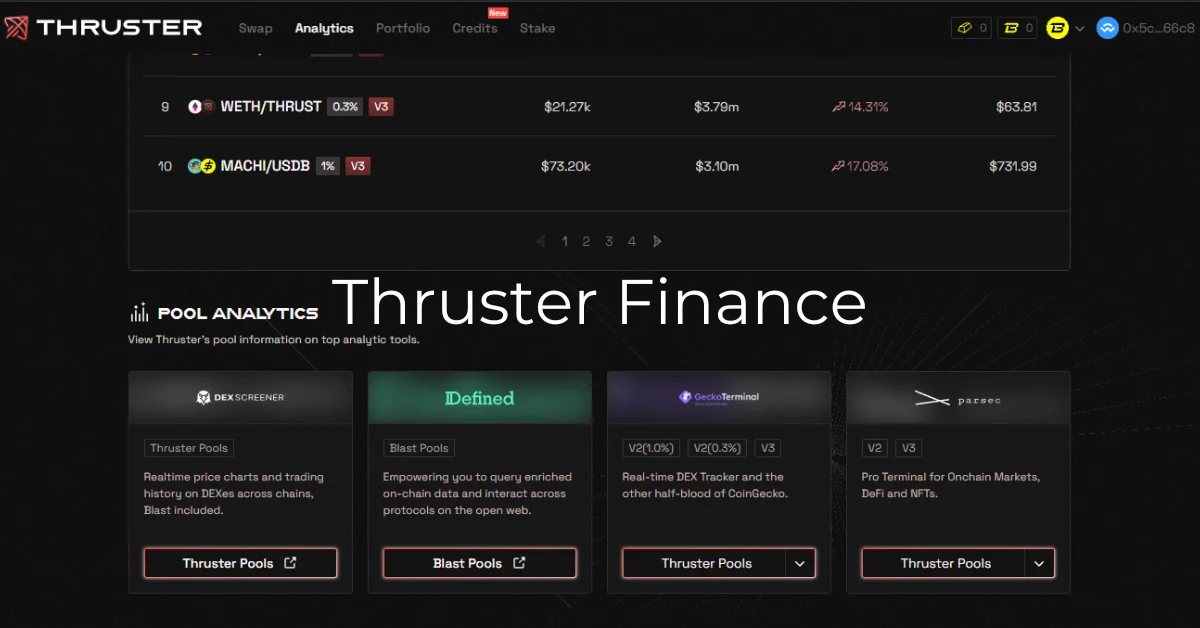

Thruster Finance Credits operate as a digital currency within the Thruster Finance ecosystem. Users earn these credits by participating in various activities, such as trading or providing liquidity.

The system is designed to reward engagement and loyalty. For every transaction you make, a percentage goes back into your account as credits.

These credits can then be used for multiple purposes. You might redeem them for lower trading fees or even exclusive products available on the platform.

Tracking your earned credits is straightforward through the user dashboard. This transparency helps you plan how and when to use them effectively.

Moreover, the value of these credits fluctuates based on market dynamics, adding an element of strategy to their utilization. Keeping an eye on market trends can enhance your rewards significantly.

Benefits of Using Thruster Finance Credits

One of the standout benefits of using Thruster Finance credits is the flexibility they offer. Users can easily exchange these credits for various services, enhancing their financial transactions without hassle.

Thruster Finance credits also enable users to access exclusive features and rewards. Whether it’s lower transaction fees or special bonuses, having these credits in your account elevates your overall experience.

Additionally, utilizing these credits often leads to improved cash flow management. By effectively leveraging them, individuals can maximize their purchasing power while minimizing unnecessary expenses.

Another key advantage lies in the potential for passive income generation. Holding onto Thruster Finance credits may allow users to earn interest over time, contributing to long-term financial growth.

Being part of this ecosystem means staying updated with financial trends and tools that enhance investment strategies. It keeps you informed and ready to make smart decisions in a dynamic market environment.

ALSO READ: invest1now.com Real Estate: Empowering Simple Investments

Different Ways to Earn and Use Thruster Finance Credits

Earning Thruster Finance Credits can be an exciting journey. Users have multiple avenues at their disposal to accumulate these valuable credits.

Participating in trading activities is one of the most popular methods. Every transaction you make could potentially earn you credits, enhancing your overall trading experience.

Another option is engaging with community events and promotions hosted by Thruster Finance. These often provide limited-time opportunities to gain additional credits through contests or challenges.

You can also benefit from referral programs. By bringing new users into the Thruster Finance ecosystem, you not only help grow the platform but earn rewards as well.

Once you’ve amassed some credits, using them wisely becomes crucial. You can redeem them for lower transaction fees or even exclusive access to premium features and services within the platform.

These various strategies ensure that users remain engaged while maximizing their benefits from Thruster Finance Credits.

Tips for Maximizing Rewards with Thruster Finance Credits

To maximize your rewards with Thruster Finance credits, start by familiarizing yourself with the platform’s offerings. Understanding how points are earned will help you strategize your spending and investment.

Engage in regular promotions and limited-time offers. These can significantly boost your earnings when used wisely. Keep an eye on emails or notifications for opportunities to earn extra credits.

Consider diversifying your activities within the platform. Using a combination of services—like trading, staking, or participating in governance—can lead to greater credit accumulation.

Don’t forget about referral programs. Inviting friends can not only enrich their experience but also add bonuses to your own card balance.

Track your progress consistently. Monitoring how many credits you have accrued allows you to plan future transactions effectively and capitalize on beneficial situations as they arise.

ALSO READ: Plutoscreen com: A Smart Solution for Digital Business Needs

Potential Risks and Precautions to Take

Using Thruster Finance’s Credits can be rewarding, but it’s essential to stay vigilant. One of the primary risks is market volatility. The value of credits can fluctuate based on demand and supply dynamics.

Fraudulent activities also pose a threat. Always ensure you’re engaging with official platforms to avoid scams or phishing attempts.

It’s wise to diversify your earning strategies. Relying solely on one method can expose you to unnecessary risk if that avenue becomes less profitable.

Additionally, keep track of expiration dates for any credits you earn. Missed deadlines could mean lost rewards.

Regularly review terms and conditions associated with Thruster Finance’s Credits. Changes in policies may impact how you earn or redeem your credits over time, so being informed helps safeguard your investments.

Conclusion

Maximizing the potential of Thruster Finance Credits can transform your financial journey. Understanding how these credits work and their various benefits allows you to make informed decisions that enhance your experience.

Learning the different ways to earn and utilize credits opens up opportunities for additional rewards. Implementing effective strategies ensures you get the most value out of each transaction or investment.

While there are numerous advantages, it’s also essential to be aware of the risks involved. Taking necessary precautions will safeguard your interests as you explore this innovative finance platform.

Thruster Finance presents an exciting opportunity in a rapidly evolving landscape. Embracing its features with knowledge and caution can lead to substantial rewards on your financial path. Dive into what Thruster Finance has to offer, and watch your investments flourish.

ALSO READ: Fintechzoom.com CAC 40: A Deep Dive into France’s Top Index

FAQs

What is “Thruster Finance”?

Thruster Finance is a platform offering digital currency rewards for financial activities like trading and liquidity provision, enhancing users’ financial strategies.

How do I earn Thruster Finance’s Credits?

You can earn credits by engaging in trading, participating in community events, or using referral programs to invite new users to the platform.

What are the benefits of using Thruster Finance’s Credits?

These credits offer rewards such as lower transaction fees, exclusive product access, passive income opportunities, and improved cash flow management.

Can I use Thruster Finance’s Credits for anything other than trading?

Yes, credits can be redeemed for a variety of services within the platform, including access to premium features, bonuses, and other financial benefits.

What are the risks associated with Thruster Finance Credits?

Key risks include market volatility, potential fraud, and expired credits. It’s important to stay informed about the platform’s policies and track your credit usage carefully.